8.6.2.6 Entry of fees and classes - LUPMISManual

Main menu:

- 0. Introduction

- 1. GIS handling

-

2. GIS data entry

- 2.1 Create new layer

- 2.2 Digitize line

- 2.3 Digitize point

- 2.4 Digitize polygon

- 2.5 Edit existing layer

- 2.6 Delete feature

- 2.7 Split line

- 2.8 Split polygon

- 2.9 Merge lines from different layers

- 2.10 Unite lines

- 2.11 Snap lines

- 2.12 Join polygons

- 2.13 Extend polygon

- 2.14 Insert island

- 2.15 Define unit surrounding islands

- 2.16 Create 'doughnut'

- 2.17 Fill 'doughnut' polygon

- 2.18 Fill polygon with 'holes'

- 2.19 Digitize parcels from sector layout

-

3. GIS operations

- 3.1 Create buffer

- 3.2 Create exclusion zone

- 3.3 Overlay units

- 3.4 Convert line to polygon

- 3.5 Derive statistics (area size, length)

- 3.6 Clip unit according to other unit

- 3.7 Create geographic grid

- 3.8 Move entire vector map

- 3.9 Move or copy individual features on a map

- 3.10 Adjust polygon to line

- 3.11 Convert points to polygon

- 3.12 Define by distance

- 3.13 Create multiple objects

- 3.14 Transfer styles from one layer to another

-

4. Attribute database

- 4.1 Start with database

- 4.2 Import database

- 4.3 Display database information

- 4.4 Enter attribute data

- 4.5 Attribute matrix of multiple layers

- 4.6 Seeds

- 4.7 Repair attribute data

- 4.8 Merge lines with attached database

- 4.9 Transfer attribute data from points to polygons

- 4.10 Copy styles, labels, attributes

-

5. Conversion of data

-

5.1 Points

- 5.1.1 Import list of points from text file

- 5.1.2 Import list of points from Excel file

- 5.1.3 Convert point coordinates between projections

- 5.1.4 Convert point coordinates from Ghana War Office (feet)

- 5.1.5 Convert point coordinates from Ghana Clark 1880 (feet)

- 5.1.6 Track with GPS

- 5.1.7 Download GPS track from Garmin

- 5.1.8 Download GPS track from PDA

- 5.1.9 Frequency analysis of points

- 5.2 Vector maps

- 5.3 Raster maps

-

5.4 Communication with other GIS programs

- 5.4.1 Import GIS data from SHP format

- 5.4.2 Import GIS data from E00 format

- 5.4.3 Import GIS data from AutoCAD

- 5.4.4 Export LUPMIS data to other programs

- 5.4.5 Export GIS to AutoCAD

- 5.4.6 Change a shape file to GPX

- 5.4.7 Transfer GIS data to other LUPMIS installations

- 5.4.8 Digitize lines in Google Earth

- 5.5 Terrain data

- 5.6 Export to tables

- 5.7 Density map

-

5.1 Points

-

6. Presentation

- 6.1 Labels

- 6.2 Styles and Symbols

- 6.3 Marginalia

- 6.4 Legend

- 6.5 Map template

- 6.6 Final print

- 6.7 Print to file

- 6.8 3D visualization

- 6.9 External display of features

- 6.10 Google

-

7. GIS for land use planning

- 7.1 Introduction to land use planning

- 7.2 Land use mapping for Structure Plan

- 7.3 Detail mapping for Local Plan

- 7.4 Framework

- 7.5 Structure Plan

- 7.6 Local Plan

- 7.7 Follow-up plans from Local Plan

- 7.8 Land evaluation

-

8. LUPMIS Tools

- 8.1 General

-

8.2 Drawing Tools

- 8.2.1 Overview

- 8.2.2 UPN

- 8.2.3 Streetname + housenumbers

- 8.2.4 Lines

- 8.2.5 Arcs

- 8.2.6 Polygons

- 8.2.7 Points

- 8.2.8 Cut line

- 8.2.9 Other Drawing Tools

- 8.2.10 Import

- 8.2.11 Projections + conversions

- 8.2.12 Format conversion

- 8.2.13 Other GIS Tools

- 8.2.14 Utilities

- 8.3 Printing Tools

- 8.4 Permit Tools

- 8.5 Census Tools

-

8.6 Revenue Tools

- 8.6.1 Overview

- 8.6.2 Entry of revenue data

- 8.6.3 Retrieval of revenue data

- 8.6.4 Revenue maps

- 8.6.5 Other revenue tools

- 8.7 Reports Tools

- 8.8 Project Tools

- 8.9 Settings

-

9. Databases

- 9.1 Permit Database

-

9.2 Plans

- 9.2.1 Accra

- 9.2.2 Kasoa

- 9.2.3 Dodowa

- 9.2.4 Sekondi-Takoradi

-

9.3 Census Database

-

9.4 Revenue Database

-

9.5 Report Database

-

9.6 Project Database

- 9.7 Address Database

-

Annexes 1-10

- A1. LUPMIS setup

- A2. Background to cartography/raster images

- A3. Glosssary

- A4. Troubleshooting

- A5. Styles

- A6. Classification for landuse mapping/planning

- A7. GIS utilities

- A8. Map projection parameters

- A9. Regions / Districts

- A 10. Standards

-

Annexes 11-20

- A11. LUPMIS distribution

- A12. Garmin GPS

- A13. Training

- A14. ArcView

- A15. Population statistics

- A16. Entry and display of survey data

- A17. External exercises

- A18. Programming

- A19. Paper sizes

- A20. Various IT advices

- A21. Site map and references

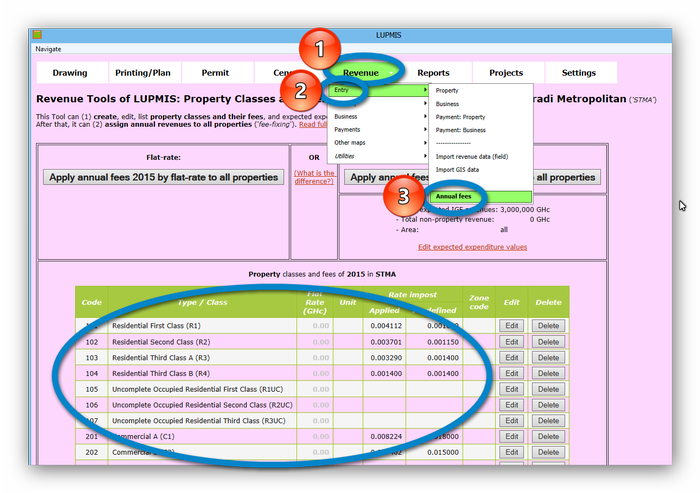

8.6.2.6 Manual Entry and Import of Fees and Classes

Level of expertise required for this Chapter: Intermediate; specifically for LUPMIS @ TCPD

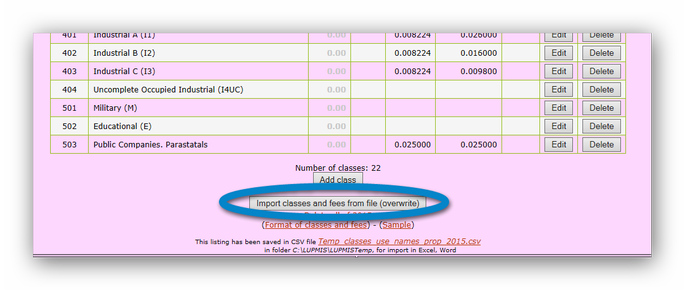

Similar to property / business data collected in the field, these fees can be entered either on-screen or through an import procedure from a CSV file. The example below marks the option of import of fees from an external file.

Be sure that you have entered the definition of fees and classes in the correct format in the CSV Excel file. This is very important. See definition of formats for property fees and business fees.

Revenue > Entry > Annual fees > Property or Business > Select year > Continue > Import classes and fees from file

The model and the procedures are explained in following Chapter 8.6.2.7.

For property uses, they should be grouped in 7 groups:

- 100+ Residential uses

- 200+ Commercial uses

- 300+ Mixed uses

- 400+ Industrial uses

- 500+ Civic and cultural uses

- 600+ Sanitary facility

- 700+ Corporations and other uses

For example, 101 for residential class A, 102 for residential class B etc

For business classes, there is no equivalent, but they should also be grouped in 100 numbers, for example 1700+ hairdressers, 400+ car repair shops.